Danajamin provide financial guarantee insurance for bonds and sukuk issuances to viable Malaysian companies to enable access to the Corporate Bond market. Market capitalisation the current value of all crypto coins mined is currently estimated at US12 trillion down from around US2 trillion in March just when it seemed that crypto was firmly on its way to becoming a mainstream asset.

Pdf The Regulatory Framework Of Digital Currencies In Malaysia A Conceptual Paper

One of the significant milestones in providing a robust regulatory and supervisory framework was the enactment of the Development Financial Institutions Act 2002 DFIA to ensure financial and operational soundness of the DFIs and that the institutions perform their mandated roles prudently efficiently and effectively.

/31498782854_a770d60990_c-779fb533456146bd89dc4afa766de463.jpg)

. It has always been Bursa Malaysias priority to demonstrate the highest standards of integrity to our shareholders and the investment community. Subscribe to our RSS feeds and get the latest Bursa Malaysia news delivered directly to your desktop. For matters relating to Investor Relations.

CRYPTOCURRENCIES spectacular crash in May has been likened to a bank run. Tesla for instance had bought US15. Investors who wish to trade in securities listed on Bursa Malaysia must open CDS accounts with Authorised Depository Agents ADAs ie.

We are committed to building long-term relationships based on fair and timely disclosure transparency openness and constructive communication. We are committed to building long-term relationships based on fair and timely disclosure transparency openness and constructive communication. The Swiss State Secretariat for International Finance SIF and the Monetary Authority of Singapore MAS jointly issued a statement of intent to promote data connectivity for financial services.

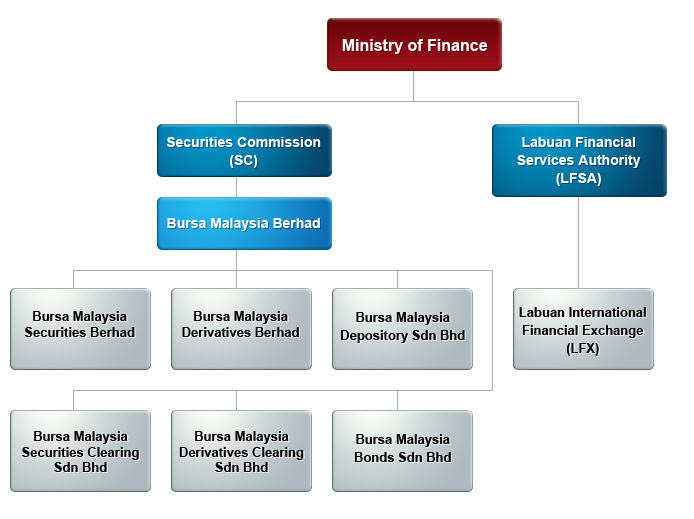

The Federal Reserve System relies on the timely and accurate filing of report data by domestic and foreign financial institutions. For matters relating to Investor Relations. The MIFC Community is a network of the countrys financial sector regulators including Bank Negara Malaysia Central Bank of Malaysia Securities Commission Malaysia Labuan Financial.

Regulatory framework in UAE. KUALA LUMPUR June 9. Futureproofing the financial sector workforce.

Likewise for securities sold these securities will be debited from the CDS accounts. Our regulatory focus for financial development Box Article. Securities bought will be credited into CDS accounts that the investors have opened.

For this initiative to succeed it must address concerns among regional partners about the frameworks form function benefits inclusivity. The data collected from these regulatory reports facilitates early identification of problems that can threaten the safety and soundness of reporting institutions and ensures timely implementation of legal corrective. Labuan International Financial Exchange LFX Co-Location Service BTS2 On-Boarding.

Click on the orange RSS button to go to the. Market regulators are urged to formulate a clear regulatory cryptocurrency framework to facilitate the particiaption of institutionsMX Global Sdn Bhd chief executive officer Datuk Fadzli Shah said the regulation and licensing pathway is the crux of the problem which may slow down the cryptocurrency adoption for institutions in. The Financial Services Regulatory Authority FSRA which is the financial regulator of the Abu Dhabi Global Markets ADGM a free zone in Abu Dhabi has become the first regulator in the UAE to issue comprehensive guidance and regulations on carrying out activities relating to cryptocurrencies.

Download the Brief The Issue The proposed Indo-Pacific Economic Framework IPEF is the Biden administrations answer to questions about the United States economic commitment to the vital Indo-Pacific region. Medium-term priorities for the prudential framework and anti-money laundering and countering financing of terrorism AMLCFT. About Bursa Malaysia Regulatory Regulatory ApproachPhilosophy Supervision of Issuers Supervision of Brokers.

Malaysias Islamic finance marketplace is served by the Malaysia International Islamic Financial Centre MIFC Community founded on the launch of the MIFC initiative in 2006. Regulatory Governance Framework Code of Conduct Anti-Bribery and Anti-Corruption. Malaysias Financial Sector Blueprint 2022-2026 unveiled at MyFintech Week 2022.

Danajamin National Berhad is Malaysias first and only Financial Guarantee Insurer. SIF and MAS said that they recognise the importance of a sound regulatory and policy framework especially one that is conducive for the cross-border transmission. It has always been Bursa Malaysias priority to demonstrate the highest standards of integrity to our shareholders and the investment community.

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

Company Secretary Company Secretary Accounting Services Company

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

10 Key Themes For Trends And Regulatory Priorities Deloitte Netherlands

Preparing Bank Compliance For Future Complexities Bcg

Making Regulatory Compliance More Responsive To Change Bcg

2021 128 Malaysia S Regulatory Framework A Catalyst For Fintech Adoption By Nafis Alam Iseas Yusof Ishak Institute

Welcome To The Elliptic Blog Crypto Regulation

Preparing Bank Compliance For Future Complexities Bcg

Malaysia S Finance Minister Says Crypto Issuance Must Defer To Central Bank Bitcoin Btcpeek Freeb Cryptocurrency News Cryptocurrency Bitcoin Mining Hardware

Global Risk 2018 Future Proofing The Bank Risk Agenda

Pharmaboardroom Marketing Manufacturing Packaging Labeling Advertising Romania

Kucoin 2018 Review Analyzing This Exchange S Features Criptomoneda La Bolsa De Valores Toronto